27+ removing pmi from mortgage

So if you dont ask your lender to get rid of your PMI when your home equity reaches 20 they should remove it for you once your home equity. Ad Check Your VA Loan Eligibility for 0 Down No PMI and Lower Monthly Payments.

Can You Remove Pmi From Your Mortgage

Loan-to-value ratio LTV of your mortgage falls to 78.

. Once you reach 22 equityand the LTV. Web Four Conditions for PMI Removal 1. Web While PMI is an initial added cost it enables you to buy now and begin building equity versus waiting five to 10 years to build enough savings for a 20 down payment.

Let it cancel automatically Approximately one in five mortgages in the US. Web PMI automatically drops off of conventional loans once the loan balance is at or below 78 of the homes appraised value. Web The Cost of PMI.

Although banks will automatically remove PMI once the value of your loan drops to 78 of your homes original value you can request to have. Web Under the Homeowner Protection Act HPA also called the PMI Cancellation Act your mortgage lender is obligated to cancel your PMI when you either pay off 78 percent of the original purchase price of your mortgage or when youve reached the half-way point of. This is called automatic cancellation And by law your mortgage.

You can ditch your BPMI by. Besides getting a lower rate refinancing might. Contact us at 800-365-7772 to review your request.

PMI costs can range from 025 to 2 of the loan balance per year depending on the size of the down payment and mortgage the loan term and the borrowers credit score. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. To cancel the PMI completely you will have to reach the 80 mark in terms of the LTV. As you build equity the LTV declines.

Web PMI protects the lendernot youif you stop making payments on the loan. Ad Check Your VA Loan Eligibility for 0 Down No PMI and Lower Monthly Payments. While the amount you pay for PMI can vary you can expect to pay approximately between 30 and.

In the case of. Web 27 removing pmi from mortgage Thursday March 9 2023 Edit. Web How to get rid of PMI before hitting the 78 threshold.

In general youll pay between 30 and 70 per month for every 100000 borrowed according to Freddie Mac a government-sponsored enterprise that buys and sells mortgages on. Due to the various guidelines involved a specialist must review the account to determine if PMI can be removed. Web By law a lender must automatically cancel BPMI once the.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. It applies to almost all conventional loans with less than 20 down payment including conforming loans backed by Fannie Mae and Freddie Mac.

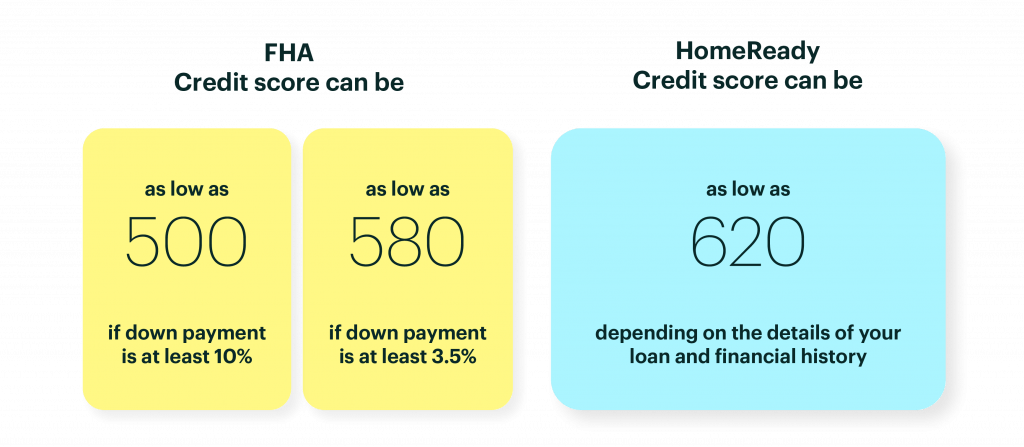

Get The Answers You Need Here. Web The PMI will automatically drop off either when the LTV ratio has reached 78 or when youve reached the midway point for your loan term. You have to have a conventional mortgage not an FHA to get your mortgage insurance removed.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. In most cases FHAs mortgage insurance remains for the life of the loan. Web There are a few ways to stop paying PMI on a conventional mortgage.

Have PMI and most of these homeowners will make monthly payments for about five years and then the insurance automatically ends because they. Web How can I request to get private mortgage insurance PMI removed from my mortgage. Web Your loan servicer must cancel your BPMI when the unpaid balance of your loan is scheduled to reach 78 of your original property value provided your loan is current or when it reaches its halfway point eg 15 years on a 30 year mortgage.

Web Lenders are typically required to remove private mortgage insurance from your loan when your home equity reaches 22. Web There are four ways to remove PMI. You can wait until the lender or servicer automatically cancels it or you can contact the lender or servicer once the.

Web Refinance to get rid of PMI If interest rates have dropped since you took out the mortgage then you might consider refinancing to save money. Web There are four ways to remove PMI. Web The PMI will automatically drop off either when the LTV ratio has reached 78 or when youve reached the midway point for your loan term.

Web PMI stands for private mortgage insurance. Web You can request PMI termination from your lender once you reach 20 equity in your home through your monthly mortgage payment based on the original value of your home when you took out the.

The Importance Of Providing Required Documents For Home Loans

Private Mortgage Insurance Pmi When It S Required And How To Remove It

Castle Rock News Press 101812 By Colorado Community Media Issuu

How To Get Rid Of Pmi Experian

Refinance 411 Say Goodbye To Pmi

How To Remove Pmi From Your Mortgage Freeandclear

3dorjmpxak Lam

Hometown Oneonta 9 8 17 By All Otsego News Of Oneonta Cooperstown Otsego County Ny Issuu

How To Remove Pmi From Your Mortgage Freeandclear

How To Get Rid Of Pmi Nerdwallet

How To Get Rid Of Pmi Rocket Mortgage

How To Get Rid Of Pmi Nerdwallet

What Is A Private Mortgage Insurance On Mortgage In Nyc Nestapple

Global Economic Outlook And Investment Strategy 2020 Pdf Financial Analyst Investment Banking

Private Mortgage Insurance Pmi Is Neither Good Nor Bad

![]()

How To Get Rid Of Pmi Nerdwallet

Thursday 30th July 2020 By Thisday Newspapers Ltd Issuu